17/09/2025 - Upheaval TGE & S2

gUP,

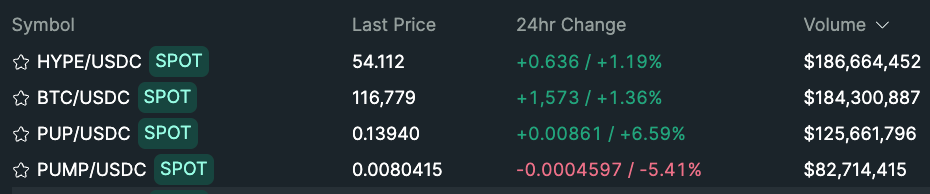

In one of the most anticipated events of the year on Hyperliquid, Upheaval protocol will be conducting its TGE after one of the shortest points program in crypto history (~20 days). In the span of < 1 month, the protocol has achieved a few key milestones:

Top DEX TVL on Hyperliquid with ~150m USD in TVL (generating close to $80k USD daily revenue, and increasing 20%-30% day on day)

Top 5 largest revenue protocol on Hyperliquid, excluding Hyperliquid itself (by Defillama data — by including spot deployer fees)

3rd most traded spot asset on Hyperliquid core: $PUP (averaging over $30k USD daily in trading revenue on one asset alone)

Press enter or click to view image in full size

It bears reminding that Upheaval is more than a DEX. The goal of Upheaval is to become the de-facto deployer of quality HyperEVM assets onto Hypercore. This extends into perpetual listings of the same quality HyperEVM assets onto HIP-3. The Upheaval protocol uniquely solves the following:

Communal deployment of quality HyperEVM assets on Hyperliquid core for CLOB traders to trade: Even when spot deployment gets expensive, Upheaval will be able to front the cost of asset deployment on behalf of quality projects and tokens.

Provides clear graduation crtieria for assets to attain listings on Hyperliquid which eradicates insider issues.

Liquidity issues on newly listed assets: Our incentive system coupled with our UIP-2 allows us to create a positive cycle where assets listed via Upheaval are able to attain good trading volume and good liquidity.

TGE: Airdrop & Launchpad

With the above done, let’s now talk about detailed $xyz (redacted) tokenomics which transparently shows how token allocations are used to grow the protocol.

Token Generation Event

4% (40,000,000 tokens) allocated for launchpad on Based

— Out of the 4% of the total token supply for sale, 50% will be set aside exclusively for our esteemed $PUP holders. For every dollar of $PUP you hold in Hypercore Spot and HyperEVM during the launchpad period, you can commit a dollar in $HYPE. This is our way of rewarding loyal holders in our ecosystem to ensure they get exclusive access to the launchpad. The other half will be set aside for public allocation where any users with Hype holdings can participate.

— A total of 4% of the token supply will be allocated for launchpad. Target raise is $800,000, with max raise of $3.2mil USD. Each token is priced at $0.02 initially. With higher demand, the token will be priced higher. At $3.2mil USD max raise, token price will be maximally capped at $0.08. This is a linear function where the higher the amount raised, the higher the starting price. E.g. If 2mil was raised, starting price is $0.05.

Number has been updated as of 21st September: token price will be between $0.01 to $0.036 approximately to provide higher upside for users via a lower initial marketcap

Formula: startingTokenPrice = raisedAmount / numberOfTokensRaised — Airdrop follows an overflow format where commitment amounts can be higher than $3.2mil USD, ($100mil USD even). This does not increase the price of the launchpad token beyond the max cap price. However, your allocation will decrease when the launchpad oversubscribes. Read this to learn more > Overflow Method

Airdrop Event

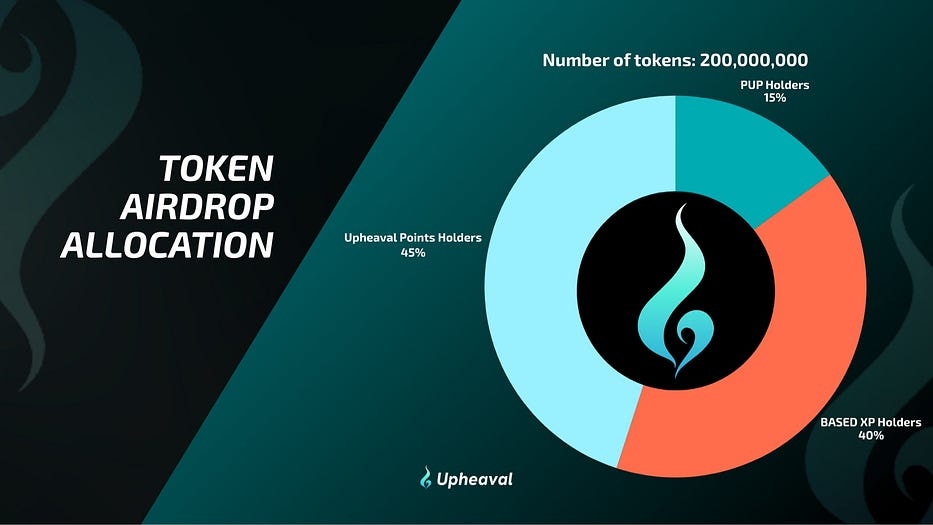

20% (200,000,000 tokens) allocated for Season 1 Airdrop, out of which (as shown below in the diagram): - 15% of airdrop allocated to $PUP holders both spot holders on Hypercore and HyperEVM - 40% of airdrop allocated to Based XP holders - 45% of airdrop allocated to Upheaval Points holders

The Upheaval team is pioneering a new airdrop format with the Based team. A boosted airdrop is created with unique game theoretic design meant to reward loyal users. Watch out for the Based article to learn more about it.

Press enter or click to view image in full size

Season 2 airdrop

Upon TGE, Upheaval will begin Season 2 airdrop system with objective targets. Upheaval points will be issued to the following activities:

Liquidity providers on Upheaval V3 and V2 DEX

Traders of $PUP and $XYZ markets (and future HyperEVM markets)

Traders on Upheaval’s HIP-3 DEX

UP & PUP Token holders

The exact breakdown will not be disclosed and is subject to adjustments as deemed necessary by the team to best support the overall growth of the protocol.

The Hyperliquid flywheel

The Upheaval protocol handles liquidity on HyperEVM, alongside spot + perp listings on HyperEVM. Our partner BasedOneX handles distribution of these listings to their active trader community of >10k MAU (which is still growing quickly).

Also, our partner RubiFi handles market-making on listed assets. This tri-partite partnership uniquely creates a flywheel to bring Hyperliquid and these 3 protocols to greater heights.

Some key thoughts:

Short points program: We believe that we have strong product market fit. Strong PMFs do not require endless points program. The shorter the points program, the more likelihood that our $XYZ token lands in the hands of people who are not only early, but also cared enough to take a deep-dive into understanding our protocol and what we do before it even becomes consensus. A good strong product will perpetuate into consensus eventually.

Season 2 airdrop: This incentive system is modelled after some of the greatest in the industry (e.g. Ethena, Hyperliquid). Users who stay on are rewarded for their belief. In fact, season 2 is designed with different goals than season 1. Season 1 was all about explosive growth in TVL. Season 2 is about optimising for key protocol metrics that provide Upheaval with the growth it seeks for.

Fee switch: Upheaval has plans of enabling fee-switch for the protocol following clear objective criteria which are met. This is to be discussed in the future for $XYZ governance.

Conclusion

Upheaval aims to democratise the listing process and to deepen Hyperliquid trading liquidity on Spot + Perp assets. This provides a strong foundation where users on BasedOneX can gain access to quality tradeable assets. Distribution + Liquidity is king. Our job is to ensure traders gain access to quality assets. This removes the need for clunky “Binance Alpha/XYZ CEX Alpha” products where transparency is arguable. All tokens and runners on Upheaval are purely organic with no insider advantage as there are simple yet clear listing requirements.

To House All of Finance, we need to create a fair, transparent, organic process for token listing to build trust with traders. It is an eventuality that Hyperliquid’s spot market will take a big chunk out of incumbents. To participate early in Upheaval is to take a shot on the belief that Hyperliquid > CEX.

Let’s Upheave the norm together.

Hyperliquid

- Firelord

Last updated